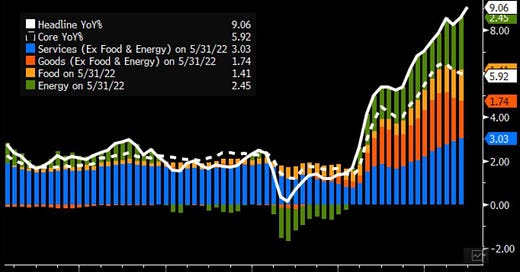

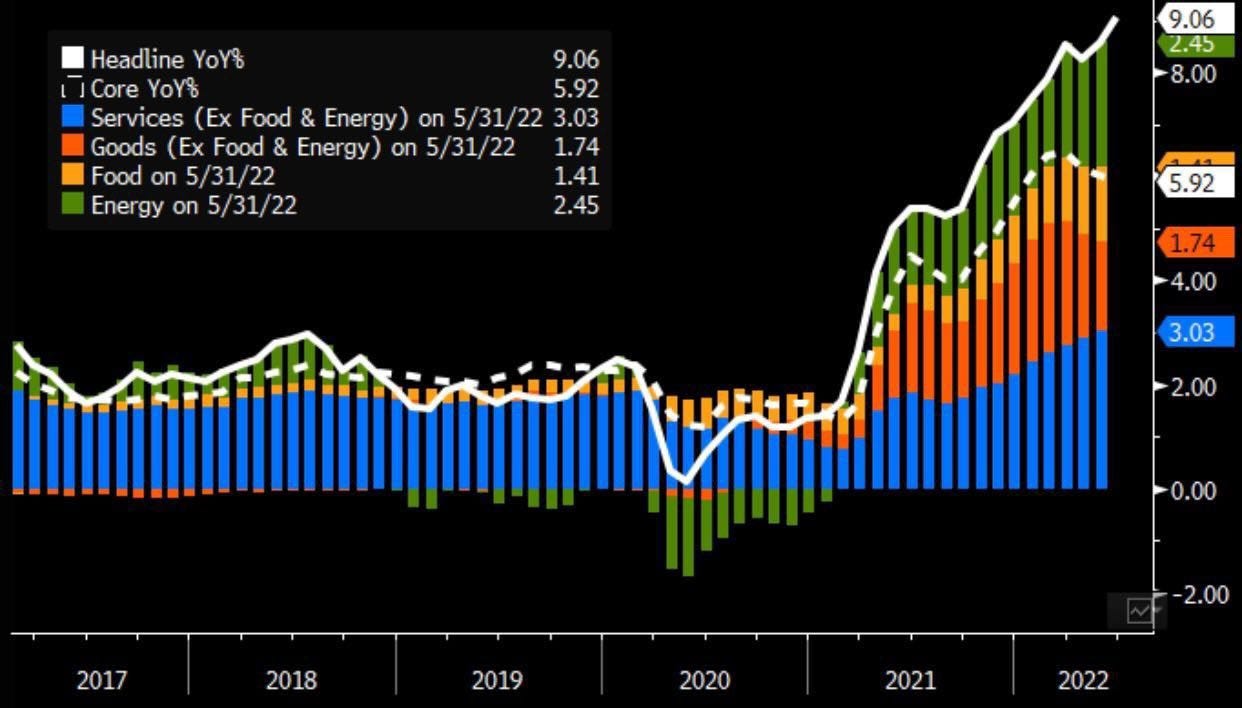

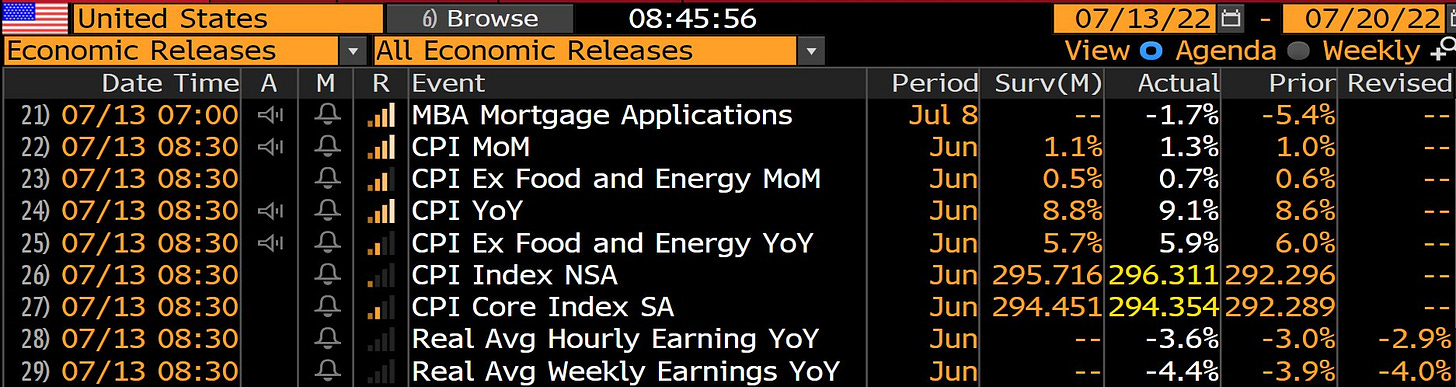

America is facing record-high inflation rates. According to U.S. Labor Department data published on July 13, the annual inflation rate for the United States is 9.1% for the 12 months ended June 2022, the largest annual increase since 1981 and after rising 8.6% previously. This rate is staggering. Disturbingly, the White House is saying that the June numbers are already out of date by the release on July 13. Real hourly wages shrunk by 3.6%, and weekly earnings shrunk by 4.4%. Practically speaking, a serious chunk of an average American’s paycheck has shrunk because of rising costs of goods.

The macroeconomic understanding of inflation focuses on the overall increase in the prices of goods. Fundamentally, inflation centers around the decrease in purchasing power per currency unit. The goals of fiscal and monetary policy include purchasing power stability. In periods of high or uncontrolled inflation, this has dangerous, short-term consequences because of the lag time between rising profits and wages and inflation. There are real-world impacts on consumers and small and medium-sized businesses. There is a myriad of reasons why this current wave of inflation most impacts these sized businesses.

Importantly, these businesses are nearly perfect passthrough for rising costs of goods and services produced. Most small businesses are a legal tax structure that controls capital raising and liability under the law. While the concept of an office or a retail location gives businesses significance in the minds of a consumer, on the backend, they’re a series of spreadsheets looking to earn more than costs.

The margin for the vast majority of small and medium-sized businesses is relatively narrow – price inflation for inputs directly eats into that profit margin. This reality is not unlike the impact taxes have on the price of goods. This means that these businesses are more likely to increase costs as a response to inflation. However, wages necessarily lag because of the profit-seeking motive behind any given business.

Competition for labor most directly causes wage increases. Like any other commodity or input to goods and services, businesses want labor to be readily interchangeable. It isn’t until there’s a shortage in talent or total labor that wages tend to increase. As a result, in a high inflationary environment, especially one seen today, wages do not rise with inflation. In fact, the lag time and difference between price increases and higher wages effectively increase. This means that despite a rise in costs, purchasing power lags.

The market is uncertain, and sometimes chance determines successes and failures. However, at the more micro level, the less abstract reality is that businesses rely on relative certainty in things like prices and customer bases to do business. Business is not done in an isolated setting but by directly interacting with others. Humans are not perfectly rational, so neither are businesses. As inflation becomes higher and less predictable, market actors face uncertainty in these business dealings, which makes them less inclined to invest, expand workforces, or do otherwise capital-intensive projects. Small businesses often do business with other small and medium-sized businesses, creating a condition by which a cascade of reduced commerce hurts everyone.

Nearly half of employed Americans work for small businesses. Now, these businesses are incredibly diverse, but especially in all-important consumer products are heavily dependent on the average American’s disposable income. The decline in purchasing power means a drop in demand for products, which creates further financial strain on these companies. Uncontrolled inflation means that the affected businesses would need to move aggressively to preserve profit margins and production; otherwise, one or both will be downsized, directly cutting into payroll numbers.

In a U.S. Chamber of Commerce survey, 44% of small business owners say that inflation is their biggest concern in Q2 2022, regardless of industry or sector. Inflation beats out supply chain issues and revenue by large margins. In the same survey, businesses reported rising prices significantly impacting their business. Small businesses reporting inflation concerns are very telling. Small businesses rely on price certainty to protect revenue. The most common responses to out-of-control prices are to raise prices and reduce payroll.

This is a predictable outcome of the deluge of government spending because of the COVID Pandemic lockdowns and emergency spending. Like the baby formula crisis, an overextension in the market can cause an overcorrection. While the rebound after the COVID-19 lockdowns ended was positive, the mass of money pushing through the system is catching up to the market.

The market is actually drowning itself in cash. While all businesses and governments are affected, wage-earners and small and medium-sized enterprises are most directly injured. Unlike major corporations, owners of small businesses also rely upon wages earned from that business like a salaried employee. Combining these realities with the fact that nearly a quarter of employed persons in the United States face profound uncertainty from inflation, as cited above, this does not bode well for the American economy.

While Republicans often beat the drum till it breaks, this is why fiscal restraint and forward-thinking when it comes to government expenditures are essential. The United States is blessed with a tremendous advantage as the world’s reserve currency and an outrageously productive economy. However, this is a well that should be tapped into only in emergencies. When the crisis ends, a reasonable and sustainable policy must take hold. Sadly, the Federal Government failed to take appropriate measures early enough to bring down inflation to appropriate, predictable levels. Prudence and first doing no self-harm must take priority in macro public policy.

Interesting that no mention is made about demographic change. Mainly how we are hitting peak Boomer retirement. From this year in out until the 2030s, retirees will be pulling more investment money out of equities than there are pre-retirees putting it in.

This will mean higher interest rates going forward.